Stripe Express vs Stripe Connect: Which One to Choose for Your Multivendor Marketplace

Are you wondering about Stripe Connect standard vs express?

Today we are going to talk about two payment modules of Dokan- Stripe Express & Stripe Connect; exclusive features, how they work, and how Stripe Express extends the facilities over Strip Connect.

The Dokan Stripe Connect module helps users to pay using their Stripe account. Also, it is able to handle the complex refund process of your marketplace.

However, recently Dokan has added the Stripe Express module. It expands the facility of Stripe by allowing buyers to use the coveted Google Pay and Apple Pay. It also supports the subscription payment system as well.

So users have been inquiring us a lot about their confusion about both of these modules. This article will hopefully answer the questions about which one to use- Stripe Connect or Stripe Express and when.

Let's get started.

What is Stripe Connect?

Stripe Connect is one of the fastest and easiest ways to connect payments to your marketplace. They have a set of programmable APIs and tools that allow you to build and scale end-to-end payment experiences from instant onboarding to global payouts, all while having Stripe handle payments KYC.

This platform supports 35+ countries and 14 languages. It enables your users to automatically calculate and collect sales tax, VAT, and GST on your Stripe transactions.

What is Stripe Express?

Stripe Express is the best way to manage your platforms or marketplace payout schedules, customize the flow of funds and control branding.

Stripe will handle onboarding, account management, and identity verification for your platform.

You can use Express accounts if you want to:

- Start quickly (letting Stripe handle account onboarding, management, and identity verification)

- Use destination charges or separate charges and transfers

- Get significant control over your user’s experience

How Does Stripe Work?

Here, we are going to talk about how Stripe works in general.

So, when a seller signs up to your marketplace, they need to create an account on Stripe. Those connected accounts represent your user in Stripe’s API and help facilitate the collection of onboarding requirements needed so Stripe can verify the user’s identity.

Now, there are three different types of connected accounts-

- Standard Accounts: Stripe Connect normally creates a standard account. A user with a Standard account has a relationship with Stripe, is able to log into the Stripe Dashboard, can process charges on their own, and can disconnect their account from your platform.

- Express Account: The express account is where Stripe handles user onboarding, account management, and identity verification on their own. Your platform can manage payout schedules, customize the flow of funds, and control branding.

- Custom Accounts: This account is mostly invisible to the account holder and Stripe has no direct contact with them. These accounts require the most integration effort and are suitable for platforms that want to control the entire user experience. Stripe recommends that you don’t build a completely custom onboarding flow.

As Stripe Connect creates a Standard account where the platform owner doesn't have much control, therefore, it is better to use the Express account where the platform owner can manage payout schedules, etc. Also, the Stripe Express account is more vigilant in fraud detection.

Interested to know more about the differences between stripe vs stripe express? Read on.

Stripe Express vs Stripe Connect: The Main Differences

Let's see the main differences between Stripe Express vs Stripe Connect.

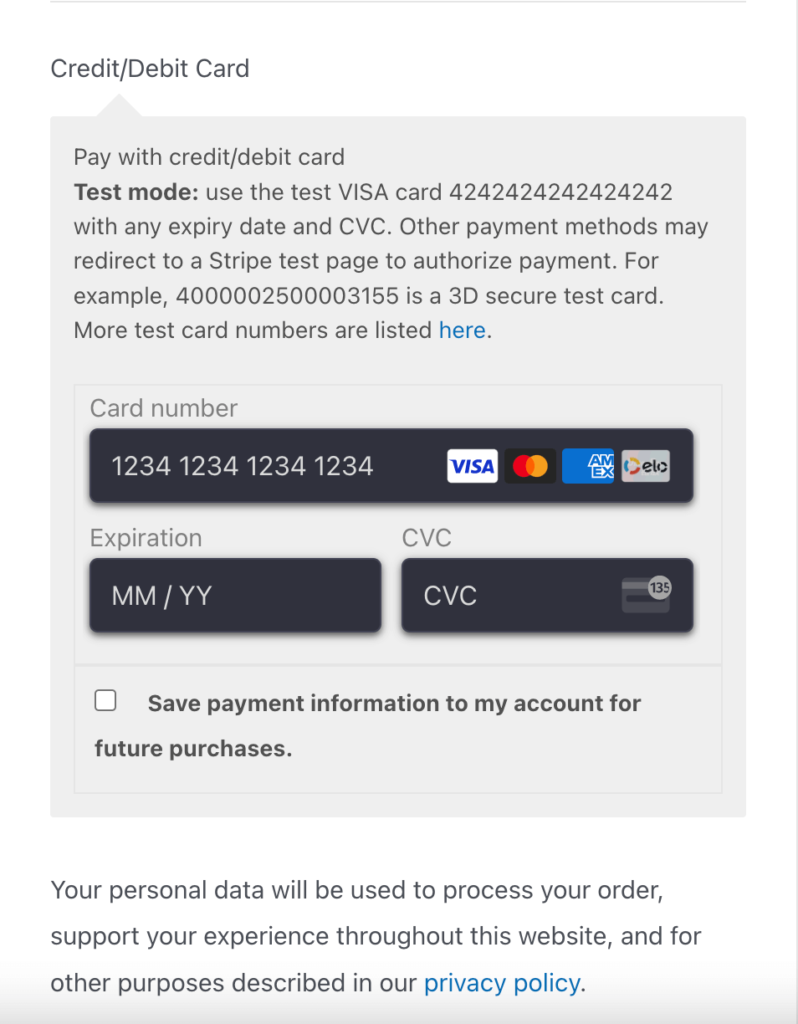

Checkout Method

Stripe Connect only supports cards as a checkout method. That means users can only use their cards to complete the Stripe Connect payment method.

Whereas Stripe Express supports multi-payment methods. That means this payment method supports,

- Card

- IDEAL

- SEPA/Debit

- APPLE/Google Pay.

Customers can use these checkout methods to complete the payment process. This is one of the main differences between stripe connect standard vs express.

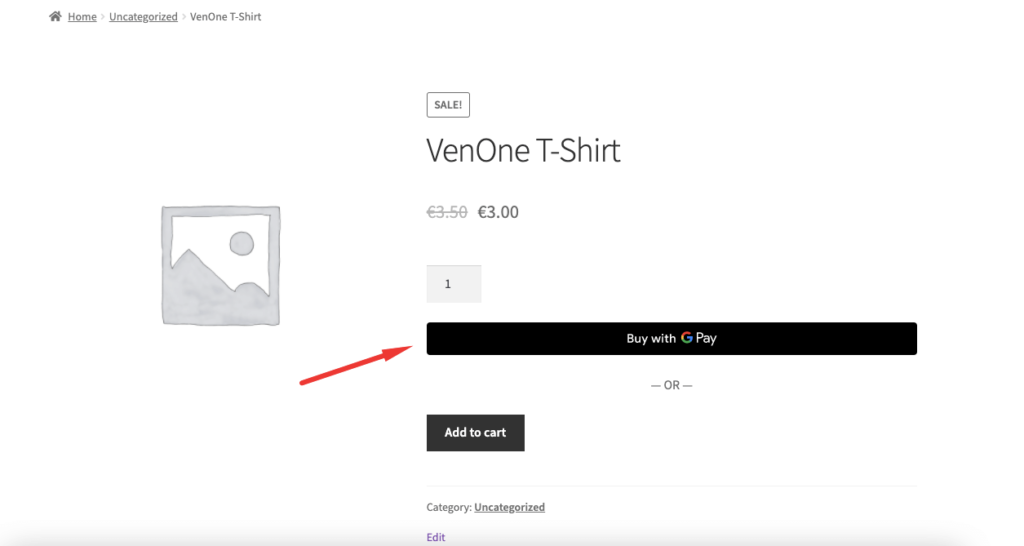

Payment Request Button

Stripe Connect payment gateway doesn't provide any payment request button. That means customers can't initiate buying with Apple Pay or Google Pay right from the product or cart page. They have to complete their purchase from the checkout page using Stripe Connect.

Stripe Express adds a payment request button on the cart page and product page. Customers can choose the payment method (Apple Pay or Google Pay) from the cart page and product page. This is very convenient for the customers and for the marketplace owner as well.

This is another difference between stripe express vs standard.

Fraud Detection

Stripe Connect doesn't handle fraud and user liability. For example, if a vendor withdraws his earnings and then any user asks for a refund, then the marketplace owner needs to handle that. Stripe Connect will not take any responsibility for that.

On the other hand, Stripe Express handles fraud and user liability. For example, if a vendor withdraws his earnings and then any user asks for a refund, then the charges will be refunded from the vendor's account as well. If there is no money in the vendor's account, then it will show a negative amount.

Are you planning to launch your first online business? Learn how to build an eCommerce website with WordPress for free.

API

Stripe Connect has backdated API. And it will lose most of its support in the future. Also, it doesn't have most of the features to support a marketplace.

Stripe Express has an updated API. It also uses Stripe subscription API. That means you can pay the recurring payments using Stripe express.

Checkout Page UI

Stripe Connect uses Card Element for checkout, which is a backdated element and has a less attractive UI.

On the other hand, Stripe Express uses the latest Payment Element with a very attractive UI that supports multi-payment methods for checkout. The customization is handled by Stripe so there is no risk involved. Moreover, there are customizable themes available so that you can design the page as you like. Like,

- Light

- Dark

- Dark Blue

- Flat.

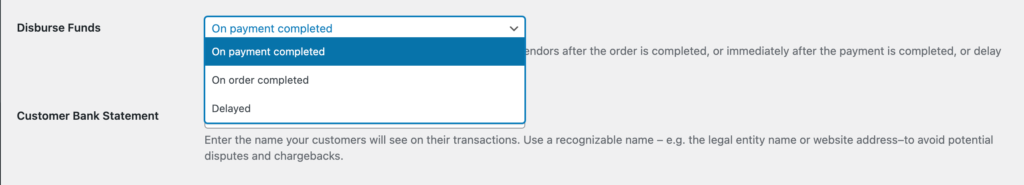

Disbursement

In Stripe Connect, as an admin, you can't choose when you want to transfer funds to vendors after the order is completed. The funds will be automatically transferred to the vendor's account after the order is completed.

In Stripe Express, as an admin, you can control when to disburse the fund to the vendor's account. It can be either order is completed, immediately after the payment is completed, or delayed the transfer is even if the order is processed or completed. The Disburse Funds option is up to you.

Account Creation

Stripe Connect creates a standard account. A Standard Stripe account is a conventional Stripe account where the account holder has a relationship with Stripe, is able to log in to the Dashboard, and can process charges on their own.

Stripe Express creates an express account. With Express accounts, Stripe handles the onboarding and identity verification processes. The platform has the ability to specify charge types and set the connected account’s payout settings programmatically. The platform is responsible for handling disputes and refunds, which is similar to a Custom account.

Privacy and Security

Stripe Connect supports purchasing products from non-connected sellers. Moreover, it supports non-3DS (SCA) payments which makes it less secure in some cases. However, it is not recommended nowadays.

On the other hand, Stripe Express has no option of purchasing products from non-connected sellers. Sellers need to be fully verified and eligible to be paid and only after that, their products can be purchased.

Also, 3DS authentication is required whenever it is needed. Authentication is performed by Stripe automatically during each payment.

Stripe Connect Standard vs Express: Which Payment Gateway Benefits You More

| Features | Stripe Express | Stripe Connect |

| Checkout Method | Support multipayment | Doesn't support multipayment |

| Payment Request Button | Button on Cart and Product Page | Doesn't have any payment request button |

| Fraud Detection | Handled by the platform | Handled by the user |

| API | Updated | Outdated |

| Checkout Page UI | Updated | Outdated |

| Disbursement | Admin has control | Automatic disbursement |

| Account Creation | Creates express account | Creates standard account |

| Privacy & Security | Doesn't support purchasing products from non-connected sellers | Supports purchasing products from non-connected sellers |

Verdict: In order to ensure a secure and transparent payment system, Stripe Express would be the better pick for your multivendor marketplace.

Considering all these advanced advantages, Dokan brings its new exclusive module- Dokan Stripe Express.

Read: How to Setup Stripe Express Payment Gateway.

Stripe Connect Standard vs Express: Make Your Choice Effectively

Now you know why you should use Stripe Express on your marketplace instead Stripe Connect.

The main target of using a secured payment gateway is to protect your marketplace and your customers from any unwanted risks. Because when they purchase using a payment gateway, they share their sensitive data and the internet is a dangerous place.

They are already skeptical of providing their data in an online store. But when they see a trusted payment gateway, then they are assured and complete their purchase process.

In order to enhance user experience and ensure a secure payment gateway, Dokan introduced its new Stripe Express module.

So, integrate Stripe Express and gain the trust of your customers.